Given the high correlation between security prices and their ratings, we wanted to follow up on some of our prior pieces that contemplated the wide discrepancies between ratings opinions provided on certain securities (see for example here and here). Split ratings, of course, present trading opportunities.

Our analysis considered securities that were acted upon by a single rating agency between June and August of 2009. We then had a look at the average ratings split as of March 28 this year: one and a half years later. The outcome was quite astonishing.

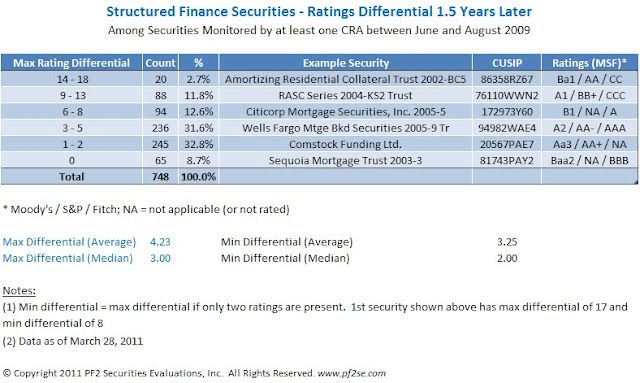

While at inception the rating agencies seem typically to achieve the same rating, down the line they tend to substantially disagree with one another. (We have broken the differential down depending on how many rating agencies rated each security. If all three of Moody's, Fitch and S&P rated the security, we'll show both a max split and a minimum split. If only two raters rated the security as of March 28, 2011, the max split equals the min split.) The average max differential: 4.23 rating subcategories (or "notches"). The median differential - 3 notches. One rating subcategory would be the difference between a AAA and a AA+.

This table shows examples of the 748 structured finance securities considered in our database at each ratings split level, including one of the 20 securities on which there was a ratings differential of between 14 and 18 ratings subcategories.

No comments:

Post a Comment